To successfully enter a new market, you need to understand the complex, competitive, and constantly changing market dynamics. It isn’t easy, as while there is a lot of data available, you need to uncover and decipher the right information. Market Maps are the perfect solution!

Mapping provides valuable insights

Market Maps provide the framework to collect the necessary data and conduct the analysis. Market Maps come in many different types (competitive, value, product, technology, positioning, partnerships & acquisition, etc.). The type of map you build is based on the questions you need answered. The key is to remember that you are analyzing the current competitors that play in and around your space to identify ways you can be more competitive. The completed map allows you to zoom in to view a specific competitor and to zoom out to determine ways to increase your competitiveness and create a Go-to-Market strategy.

Determine Customer/Product/Market Fit

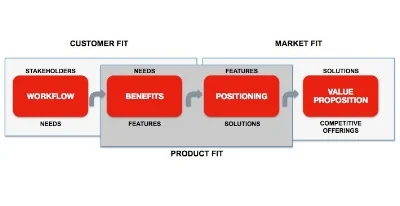

One of the primary reasons company fail to get traction in a new market is the product isn’t the right fit for customers in the market. Market Maps solve this problem down to the feature level of products. Customers buy benefits to solve needs, and benefits come from features that were developed to satisfy the needs for a specific stakeholder. Those same features can then be positioned differently and can be compared against alternatives to develop a value proposition.

One of the most powerful frameworks we use to demonstrate how products fit with customers and how the product fits with the market. Most often we start by examining the product features demanded by customers and the market.

Be more competitive

Since the goal is to drive competitive thinking, we create a Market Map that includes current and future competitors. A Market Map gives you a Birdseye view of the ecosystem and competitors. The left-hand side of the map supports a feature hierarchy that will later be used to map companies that operate in this space. What you map is entirely based on what you are hoping to learn about the market. If we are interested in how to position the product, we look at how features are bundled and the added benefits from the bundle, which set of needs, are satisfied for a stakeholder group. If we are interested in technology we look at the underlying technology of each feature or set of features. The construction of the map is driven by the question or questions under review.

Enter Complex USA markets

Recently, we helped a European-based software company map the market for business software to identify opportunities and overcome obstacles. While they had many large corporate clients in Europe, they were struggling to penetrate the lucrative USA market.

We built a Market Map that primarily focused on product positioning. A dozen or so companies’ product features were evaluated. The output for this type of analysis is best shown graphically. Must-haves are defined as what the market has come to expect from these types of offerings. We develop the must-have list either through frequency analysis (how many other products have these features) or through primary customer research (what do customers expect and value). To the left are additional features that others are using to differentiate themselves and can become an opportunity for any company.

The initial analysis showed that our client had built the right product, so why weren’t they successful selling. Interestingly, after some competitor intelligence we determined that others in the space weren’t that successful either. When we took the map out to potential customers we found something very interesting in the maturity of the market and how companies were positioning their offerings. Using the Market Map as our guide, we interviewed IT and end-users and found out where everyone was missing the mark.

Market Maps are a versatile tool

Market Maps are a highly productive way to collect and categorize competitor information. In our consulting work we have found that the construction of the market map provides insight to the market that our client’s rarely see. The map’s many uses provides another important benefit and that is the audit of intelligence and knowing where data came from and having the support to know why decisions were made. The ability to go back and update the Market Map makes it a dynamic tool that every CEO who wants to be competitive should require.