Industries have changed and the way products and services are developed and go to market have changed too. Today, the startup operates in a world of uncertainty and speed. Products are coming to market at a rapid pace, it’s no wonder why products are struggling.

To succeed in this dynamic environment, new products need context.

Startups need to spend as much time understanding the problem they are trying to solve as building the product or service. New product managers need to understand a potential customer's intent to buy before they commit to building or developing the product. Long gone are the days of "if you build it they will come".

How can startups take advantage of context? Context is the reason why we do anything. Without context it is hard to know whether we are heading in the right direction and have been successful. Lack of context has been cited as one of the reasons of wasted productivity and the biggest reason products miss the market.

There are four steps to increase context in your product design & launch. Each step builds on the prior one.

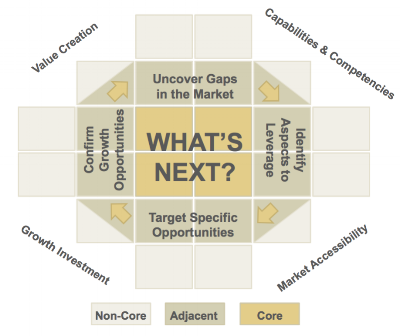

1) First, look at the problem holistically that your product solves. A broader context will help focus the effort. Take time to understand all customer segments and how different product features map to each segment.

2) Then validate the assumptions with customers. Find a dozen companies in your target market to talk to. Be very specific about the potential target market early on and it will pay huge dividends later on. Often missed at this early stage are questions regarding willingness to purchase and price thresholds.

3) Next, segment the market by these different variables. Segmenting the market this way can provide a useful method for prioritizing product features. The right segmentation will provide insight into which markets to target and eventually how to position your product offering for these markets.

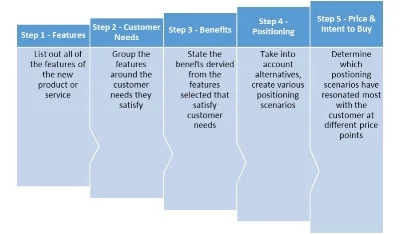

4) Finally, plot the information on a value map to reinforce context. The value map has five components: (1) features, (2) customer needs, (3) Benefits, (4) positioning, (5) and price and intent to buy.

As you go through these four steps you will determine the value that customer’s place on the features you are developing and start to develop the positioning for each segment.

It’s time to change the rules for how new products are developed & brought to market. As a startup you should always strive for context and once you discover it use it as your guidepost to launch successful new products.